Cryptocurrency trading is a volatile and fast-paced market, and understanding market cycles is crucial for success. Market cycles in cryptocurrency trading can be broken down into four main phases: accumulation, uptrend, distribution, and downtrend. During the accumulation phase, prices are at their lowest, and smart investors are buying up assets at a discount. This phase is characterized by low trading volume and a lack of interest from the general public. The uptrend phase is when prices start to rise, and the market gains momentum. This is when the general public starts to take notice and FOMO (fear of missing out) kicks in, causing prices to skyrocket. The distribution phase is when smart investors start to sell off their assets, taking profits as prices reach their peak. This phase is characterized by high trading volume and a sense of euphoria in the market. Finally, the downtrend phase is when prices start to fall, and panic selling ensues. Understanding these market cycles is essential for timing entry and exit points in cryptocurrency trading.

Another important aspect of understanding market cycles in cryptocurrency trading is recognizing the impact of external factors on market movements. Factors such as regulatory news, technological advancements, and macroeconomic trends can all influence market cycles. For example, regulatory news can cause panic selling and lead to a downtrend, while technological advancements can spark a new uptrend as investors see the potential for growth. By staying informed about these external factors, traders can better anticipate market movements and adjust their strategies accordingly.

Identifying Market Trends and Patterns

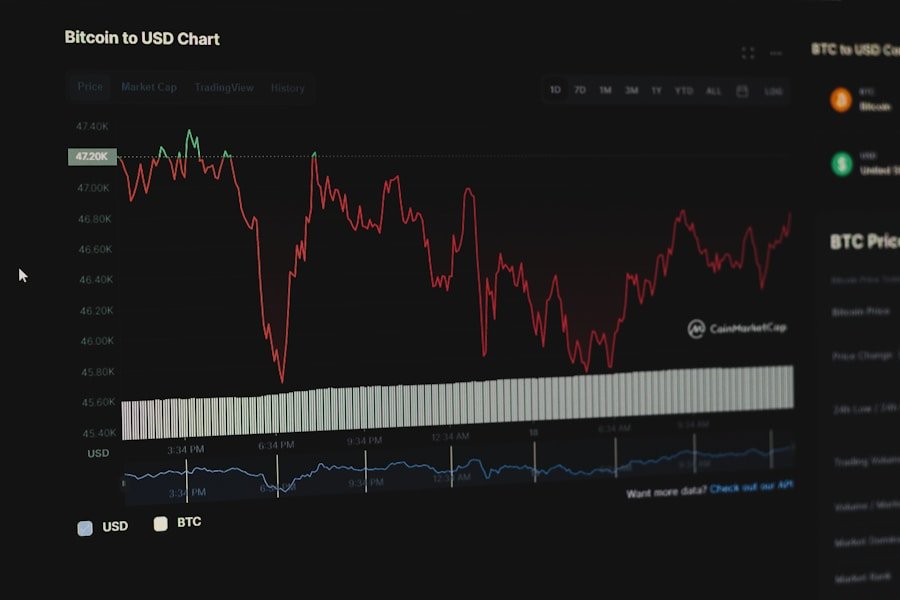

Identifying market trends and patterns is a fundamental aspect of successful cryptocurrency trading. Market trends can be categorized as either bullish (upward) or bearish (downward), and recognizing these trends is crucial for making informed trading decisions. Bullish trends are characterized by higher highs and higher lows, indicating an overall upward movement in prices. Bearish trends, on the other hand, are characterized by lower highs and lower lows, indicating an overall downward movement in prices. By identifying these trends, traders can better anticipate market movements and adjust their strategies accordingly.

In addition to identifying trends, recognizing patterns in cryptocurrency trading can also provide valuable insights for timing trades. Common patterns in cryptocurrency trading include head and shoulders, double tops and bottoms, triangles, and flags. These patterns can signal potential trend reversals or continuations, providing traders with valuable information for timing entry and exit points. By studying these patterns and understanding their implications, traders can gain a competitive edge in the cryptocurrency market.

Utilizing Technical Analysis to Time Trades

Technical analysis is a powerful tool for timing trades in cryptocurrency trading. By analyzing historical price data and identifying patterns and trends, traders can make informed decisions about when to enter or exit the market. Technical analysis involves using various indicators and chart patterns to identify potential entry and exit points. Common technical indicators used in cryptocurrency trading include moving averages, relative strength index (RSI), stochastic oscillator, and Bollinger Bands. These indicators can provide valuable insights into market movements and help traders time their trades more effectively.

In addition to technical indicators, chart patterns such as head and shoulders, double tops and bottoms, triangles, and flags can also be used to time trades in cryptocurrency trading. By studying these patterns and understanding their implications, traders can gain a better understanding of market movements and make more informed decisions about when to enter or exit the market. Technical analysis is a valuable tool for timing trades in cryptocurrency trading, providing traders with the information they need to make successful trades.

Developing a Risk Management Strategy

Developing a risk management strategy is essential for success in cryptocurrency trading. The volatile nature of the cryptocurrency market means that prices can fluctuate dramatically in a short period of time, making it crucial for traders to manage their risk effectively. One common risk management strategy used in cryptocurrency trading is setting stop-loss orders. Stop-loss orders allow traders to automatically sell their assets if prices fall below a certain level, helping to limit potential losses. By setting stop-loss orders, traders can protect their capital and minimize the impact of market downturns.

Another important aspect of risk management in cryptocurrency trading is diversification. Diversifying a trading portfolio by investing in a variety of different assets can help spread risk and minimize potential losses. By spreading investments across different cryptocurrencies or other asset classes, traders can reduce their exposure to any single asset and protect their capital from significant losses. Additionally, setting a maximum risk per trade or per day can help traders maintain discipline and avoid making impulsive decisions that could lead to significant losses.

Leveraging Fundamental Analysis for Timing

Fundamental analysis is another valuable tool for timing trades in cryptocurrency trading. By analyzing the underlying factors that drive market movements, such as supply and demand dynamics, technological advancements, regulatory news, and macroeconomic trends, traders can gain valuable insights into potential market movements. For example, positive news about a cryptocurrency’s technology or adoption could signal a potential uptrend, while negative regulatory news could lead to a downtrend. By staying informed about these fundamental factors, traders can better anticipate market movements and adjust their strategies accordingly.

In addition to analyzing fundamental factors, understanding the long-term potential of different cryptocurrencies can also provide valuable insights for timing trades. By researching the technology, use case, team, and community behind a cryptocurrency, traders can gain a better understanding of its potential for long-term growth. This information can help traders make more informed decisions about when to enter or exit the market, based on the long-term potential of different cryptocurrencies.

Using Tools and Indicators for Timing Entry and Exit Points

In addition to technical analysis and fundamental analysis, there are a variety of tools and indicators that traders can use to time entry and exit points in cryptocurrency trading. One common tool used for timing entry and exit points is Fibonacci retracement levels. Fibonacci retracement levels are based on the mathematical sequence discovered by Leonardo Fibonacci and are used to identify potential support and resistance levels in the market. By using Fibonacci retracement levels, traders can identify potential entry and exit points based on historical price movements.

Another valuable tool for timing entry and exit points in cryptocurrency trading is volume analysis. By analyzing trading volume alongside price movements, traders can gain valuable insights into market sentiment and potential trend reversals. For example, increasing volume during an uptrend could signal strong buying pressure and indicate a potential continuation of the trend, while decreasing volume during an uptrend could signal weakening momentum and a potential trend reversal. By using volume analysis alongside other tools and indicators, traders can gain a better understanding of market movements and make more informed decisions about when to enter or exit the market.

Adapting to Changing Market Conditions and Cycles

Adapting to changing market conditions and cycles is essential for success in cryptocurrency trading. The cryptocurrency market is constantly evolving, with new technologies, regulations, and macroeconomic trends shaping market movements. As a result, traders must be able to adapt their strategies to changing market conditions in order to remain successful. One way to adapt to changing market conditions is by staying informed about external factors that could impact market movements, such as regulatory news or technological advancements.

Additionally, being flexible with trading strategies and adjusting them based on current market conditions can help traders remain successful in the ever-changing cryptocurrency market. For example, if a trader’s technical analysis signals a potential trend reversal, they may need to adjust their strategy accordingly by setting stop-loss orders or taking profits at different levels than originally planned. By remaining flexible with their strategies and adapting them based on current market conditions, traders can better position themselves for success in cryptocurrency trading.

In conclusion, understanding market cycles, identifying trends and patterns, utilizing technical analysis, developing a risk management strategy, leveraging fundamental analysis, using tools and indicators for timing entry and exit points, and adapting to changing market conditions are all essential aspects of successful cryptocurrency trading. By mastering these skills and staying informed about external factors that could impact market movements, traders can position themselves for success in the fast-paced world of cryptocurrency trading.